Product Features

Our advanced technologies are designed to elevate your brokerage by delivering cutting-edge tools that drive client engagement, boost operational efficiency, and unlock new revenue streams.

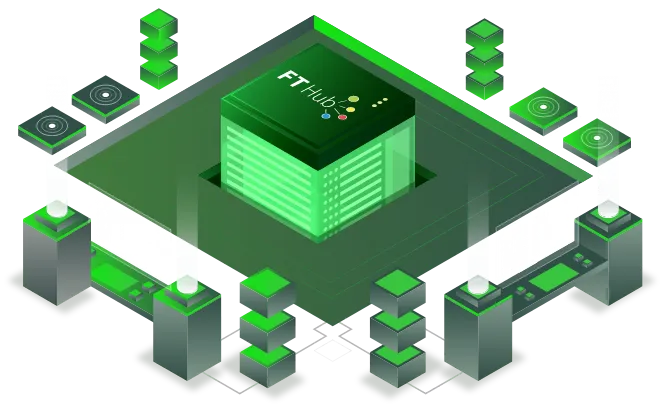

We Solve Problems With Technology

Fully adaptable, our platforms can be seamlessly integrated and configured to match your strategic goals and the distinct expectations of your traders.

Ultra-Low Latency Execution

Our infrastructure processes orders within milliseconds, significantly reducing slippage and improving client satisfaction.

Hedge Strategy Management

Hedging operations can be grouped by product or client profile and monitored at a strategic level. Brokers can easily evaluate exposure and adjust accordingly.

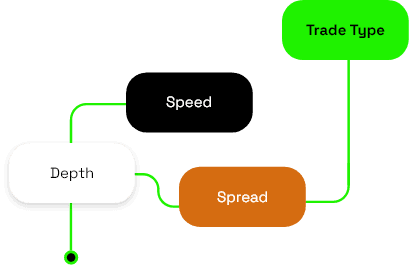

Flexible Order Routing

Order routing policies can be customized per client or client group. Routing decisions can be based on depth, speed, spread, or trade type.

Volatility and Time-Sensitive Risk Controls

For highly volatile products or peak trading times, brokers can define specific handling rules to mitigate risk and maintain system performance.

Client Segmentation

Clients can be grouped by profitability, volume, or trading behavior. Each group can be managed with different routing, pricing, and risk rules.

Intelligent Liquidity Management

The system continuously analyzes prices from multiple liquidity providers, selects the most efficient path, and routes the order accordingly. Brokers can monitor provider performance in real time and make data-driven decisions.

/>

/> Customizable A/B Book Control

Brokers can assign clients to A or B book dynamically, applying their risk strategy in real time. Profitability and risk can be tracked per book.

Real-Time Alerts & Monitoring

The system automatically detects and notifies of irregular events — such as latency spikes, abnormal spreads, or unusual client activity — enabling immediate action.

Ultra-Fast LP FIX Connectivity

The system automatically detects and notifies of irregular events — such as latency spikes, abnormal spreads, or unusual client activity — enabling immediate action.

Advanced Slippage Reporting

Introducing our Slippage Report—a powerful analytics tool that showcases exactly how your trades are executing, empowering you to identify performance trends and optimize client satisfaction.

C Book Integration for Risk Control

FTHUB now comes with native C Book integration, giving you the power to internalize trades and manage risk more profitably—no extra systems or cost.

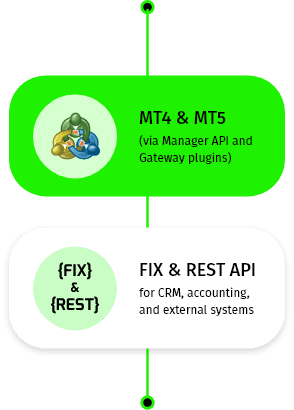

Platform Integrations

FTHUB is built for seamless connectivity. The system integrates natively with industry-standard trading platforms and connects effortlessly to third-party services through robust FIX API support.

From liquidity providers to CRMs, risk tools to payment systems—FTHUB fits right into your infrastructure with minimal effort and maximum flexibility.